Bcg Matrix X And Y Axis

Now all values are correct.

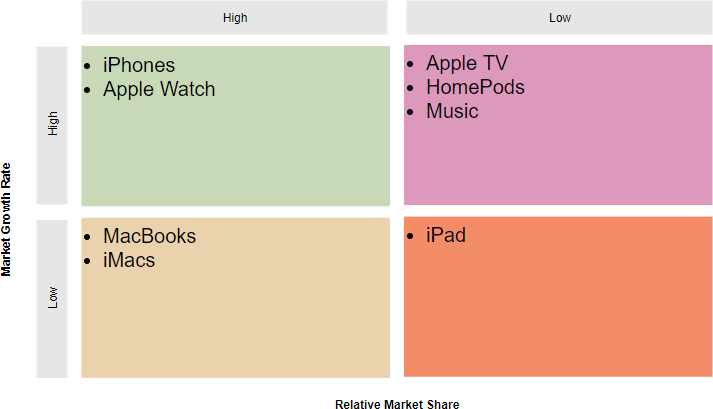

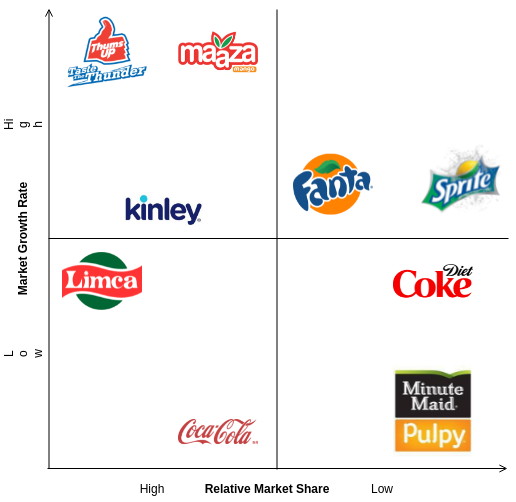

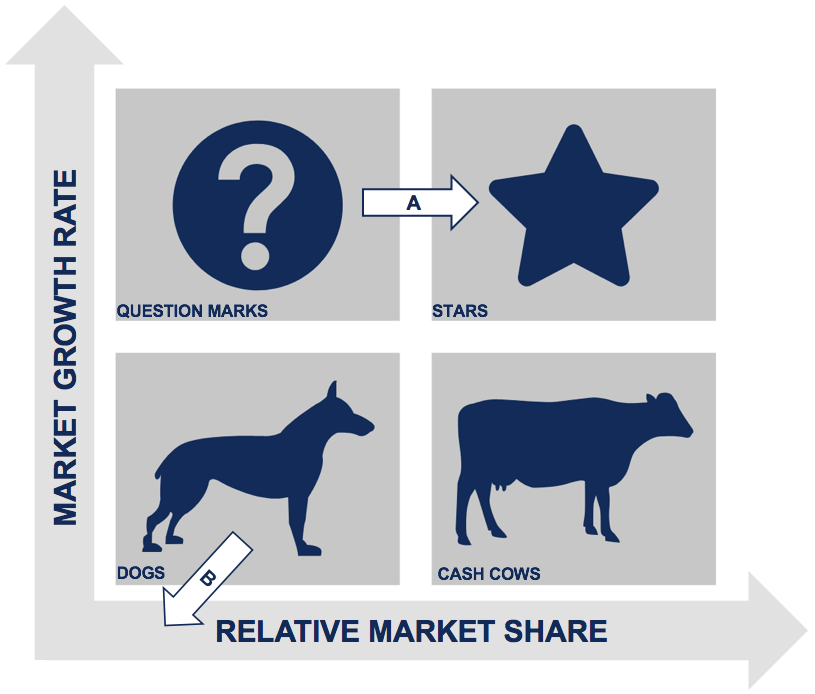

Bcg matrix x and y axis. The range is set somewhat arbitrarily. The matrix plots a company s offerings in a four square matrix with the y axis representing the rate of market growth and the x axis representing market share. Understanding the bcg matrix. The vertical axis of the bcg matrix represents the growth rate of a product.

It also helps to quantify a company s competitiveness. X axis relative market share the market share of the business sbu product in the market as compared to its competitors. Y axis indicates the growth rate of a product and its ability to grow in a particular market. By using relative market share it helps measure a company s competitiveness.

Understanding the boston consulting group bcg matrix. On the other hand the vertical axis ie. Right click x axis values and go to select data. The matrix is scored from low to high on both the x axis and y axis.

The horizontal axis of the bcg matrix represents the amount of market share of a product and its strength in the particular market. Click edit to change source of data. The horizontal axis i e. There are two axis in the bcg matrix.

X axis indicates the extent of the market share of a product and its consecutive firmness in the particular market. Let s continue formatting of x axis. It is column e in this example. You can see the bcg matrix diagram below to visualize the model.

Bcg matrix is a 4 quadrant model where the x axis is the market share or relative market share of your product service or investment and the y axis is the market growth rate. The bcg growth share matrix was developed by henderson of the bcg group in 1970s. The bcg matrix considers two variables namely. Bcg matrix or growth share matrix is a corporate planning tool which is used to portray firm s brand portfolio or sbus on a quadrant along relative market share axis horizontal axis and speed of market growth vertical axis axis.

The x axis which is the relative market share and the y axis which is the market growth rate. Select relative market share values. Now change x axis values. The overhead shows a range of 0 to 20 with division between low and high growth at 10 the original work by b headley strategy.

You have to change series x values. The x axis generally denotes the market growth rate or cash usage with the y axis denoting relative market share or cash generation.

/GettyImages-1138644649-55b5854805eb44649063271113413de8.jpg)